The Essential Role of a Bank Attorney in Today's Financial Landscape

In the intricate world of finance and banking, the role of a bank attorney is critical. These legal professionals bring a wealth of expertise that not only helps individuals and businesses navigate complex financial regulations but also protects their rights and assets. In this article, we delve into the various dimensions of a bank attorney's work, highlighting their significance in various legal areas, including criminal defense law and personal injury law.

Understanding the Responsibilities of a Bank Attorney

A bank attorney specializes in matters related to financial institutions and the legal issues surrounding them. Their responsibilities can encompass various functions, including:

- Legal Advice: They provide counsel on banking laws and regulations that impact individuals and businesses.

- Transaction Support: They assist clients in drafting and reviewing contracts related to loans, mortgages, and other financial agreements.

- Litigation Representation: In cases of disputes or lawsuits involving banks, a bank attorney represents their clients in court.

- Compliance Assurance: They ensure that clients adhere to all legal standards in their banking and financial operations.

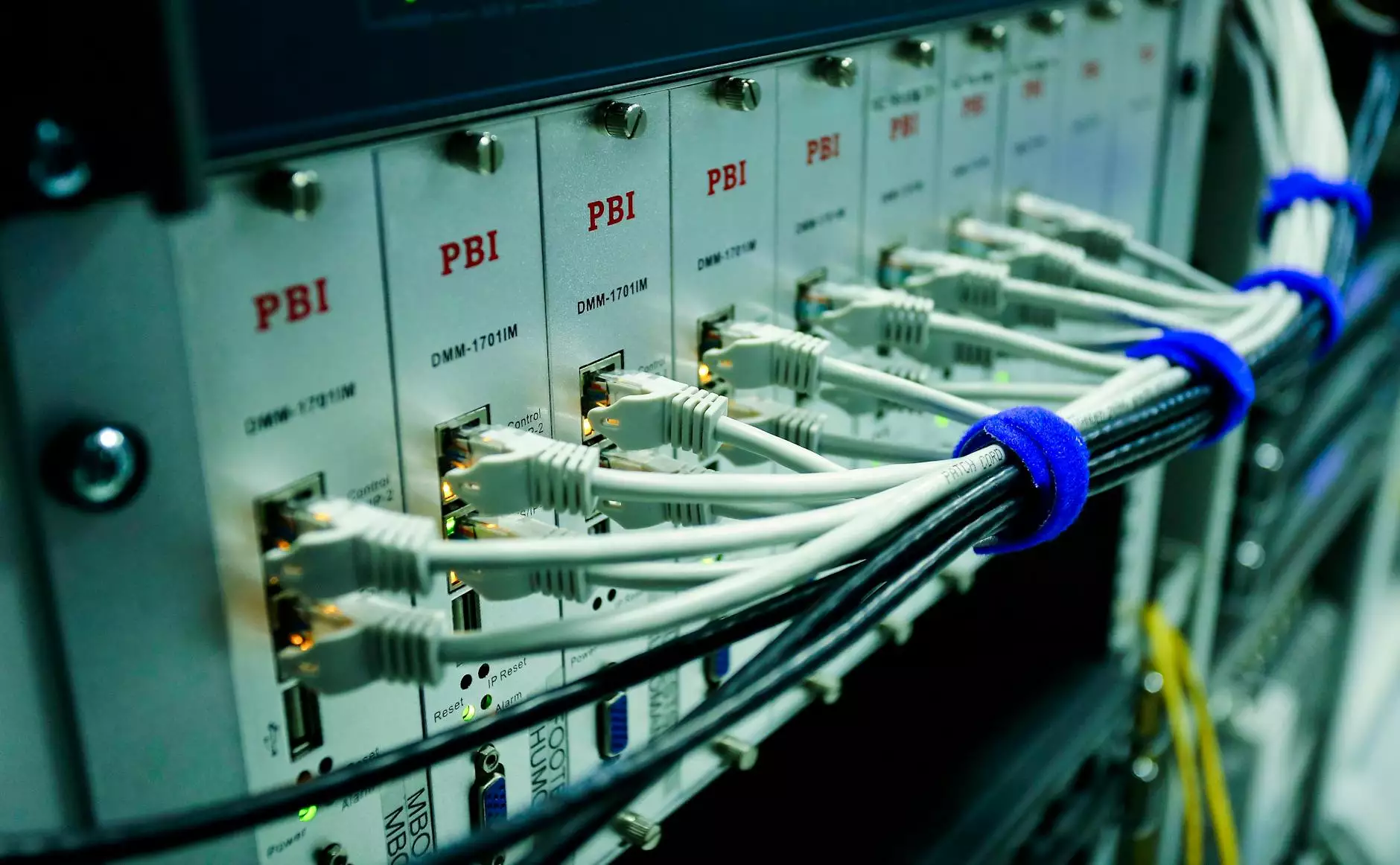

The Importance of Specialized Knowledge

The realm of banking law is highly specialized, with an ever-evolving landscape influenced by changes in legislation, market trends, and technological advancements. A proficient bank attorney is well-versed in:

- Consumer Protection Laws: They understand laws designed to protect consumers from unfair banking practices.

- Regulatory Compliance: They help organizations stay compliant with regulations set by authorities like the FDIC or the SEC.

- Commercial Transactions: They have the expertise to navigate commercial contracts and transactions that involve financial institutions.

Bank Attorneys in Criminal Defense Law

When it comes to criminal defense law, bank attorneys play an instrumental role, particularly in cases involving financial crimes such as fraud or embezzlement. Their legal acumen is crucial for:

- Defending Clients: They represent clients accused of financial offenses, ensuring they receive a fair trial and proper defense.

- Negotiating Plea Bargains: Skilled bank attorneys can negotiate plea deals that may result in lesser charges or sentences.

- Mitigating Consequences: They work to mitigate the impact of criminal charges on their clients' personal and professional lives.

Navigating Personal Injury Claims Related to Financial Institutions

In the domain of personal injury law, a bank attorney can assist clients in cases where injuries are linked to fraudulent banking practices or accidents occurring on bank premises. They guide clients through the complex legal processes involved in filing claims, including:

- Identifying Liability: Determining who is liable for damages can be complicated, and bank attorneys can help clarify these issues.

- Document Preparation: They assist in gathering and preparing necessary documents for personal injury claims.

- Representation in Settlements: Bank attorneys negotiate settlements with insurance companies and other parties involved.

Coping with Banking Disputes

Disputes can arise in various forms between clients and banking institutions. A bank attorney is vital in resolving such issues through:

- Mediation and Arbitration: They facilitate mediation or arbitration processes, often resulting in faster resolutions than traditional litigation.

- Litigation: When disputes cannot be resolved amicably, bank attorneys are equipped to represent clients in court.

- Negotiation: A skilled attorney can negotiate terms that work for both parties, avoiding the need for lengthy litigation.

The Impact of Technology on Banking Law

With the rise of digital banking, the role of a bank attorney has evolved dramatically. They must stay informed about cybersecurity laws, digital privacy regulations, and the implications of fintech innovations. Key areas of focus include:

- Data Protection: Bank attorneys help financial institutions comply with laws regarding data privacy and breach notifications.

- Fintech Regulations: They must understand how to navigate the legal landscape surrounding new financial technologies.

- Risk Management: Advising institutions on mitigating risks associated with online banking services and fraud prevention is paramount.

Choosing the Right Bank Attorney

Finding the right bank attorney is essential for anyone needing legal assistance in financial matters. Attributes to consider when selecting an attorney include:

- Experience: Look for attorneys with extensive experience in banking law and a successful track record.

- Specialization: Ensure they specialize in areas relevant to your needs, such as criminal defense law or personal injury law.

- Reputation: Research their reputation through reviews, testimonials, and professional accolades.

- Communication Skills: A good attorney should communicate clearly and keep you informed about case developments.

Conclusion

In an era where financial transactions are increasingly complex, the role of a bank attorney is more critical than ever. From understanding the nuances of banking law to navigating criminal defenses and personal injury claims, these legal professionals are pillars of support. They are essential for anyone looking to protect their financial interests, ensuring compliance with laws, and defending against any legal challenges that may arise.

For more information on how a bank attorney can aid you or your business, consider reaching out to specialized firms such as ajalawfirm.com, where experienced attorneys are ready to assist you in all matters related to banking law, criminal defense, and personal injury disputes.